News

Lancering van “De Zakengids voor de VS”

De Zakengids voor de VS is een essentiële bron voor bedrijven die succesvol willen zijn in de grootste economie ter wereld. Boordevol tips!

UPDATE: Ten Ways to Prevent Corporate Check Fraud

While fraud is persistent in all walks of life, corporations are often a routine target for scammers. The United States contains the same trickery as Europe, adding one major factor: checks.

TABS Talk – June 2024

Explore the June edition of the TABS business update, packed with essential insights for the success of your U.S. subsidiary.

Did You Know That…? When Your Foreign Entity Should Do a ‘Protective Filing 1120F’ in the U.S.

Many European companies operating in the U.S. underestimate their possible tax presence in the U.S. and its effect on Corporate Income Tax.

Will the IRS Start Responding to Abatement Requests for Incorrectly Assessing Penalties for Not (or Late) Filing Forms 5471

The IRS has statutory authority to assess penalties for willful failure to file form 5471; Earlier Tax Court decision reversed.

TABS Talk – February 2024

Explore the February edition of the TABS business update, packed with essential insights for the success of your US subsidiary.

Sales Tax Changes 2024

Explore the shifts in sales tax for 2024 as states face challenges with outdated laws amidst decreasing income tax rates. Understand the impact on services, digital goods, and the quest for sustainable taxation.

W2 or 1099? Final Independent Contractor Rule Issued

Discover the latest on the Department of Labor’s final rule on worker classification under the FLSA, effective March 11

Sales Tax Rate Changes 2024

Effective January 1st, 2024, sales tax rates will be updated. This date holds significance for many states as they review and adjust their sales tax rates or exemptions for services and goods.

TABS Talk – December 2023

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Update Beneficial Ownership Reporting

As we are moving towards the new year, businesses and foreign entities registered to operate in any U.S. state are gearing up for a significant change in their reporting obligations.

Payroll & Benefits: Update on 2024 IRS Limits and Navigating Insurance Landscape

As we almost kick off 2024, we want to inform you about key developments that may impact your payroll and benefits.

IRS Announcement 1099-K Reporting

The IRS has just announced a further transition period to lower the $600 Form 1099-K reporting threshold for third-party settlement organizations.

TABS Talk – September 2023

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

IRS Puts Immediate Stop to New ERC Claims

Many of our clients have been bombarded with calls and emails regarding the Employee Retention Credit (ERC), even if they don’t appear to qualify. In response to this situation, we want to bring your attention to a recent update from the IRS.

The Delaware Flip: A Smart Move for European Companies?

What is the Delaware Flip? Why and when is it interesting to opt for this construction? What are the disadvantages and consequences for the organization and shareholders? Let TABS guide you!

Private Office Suites Midtown NYC

Are you ready to take your business to new heights? Our conveniently located flexible office solutions meet your requirements. Let TABS guide you!

Bridging Cultural Differences for a Successful U.S. Expansion

CurTec, a Dutch company, recently established a manufacturing facility in South Carolina to cater to its expanding customer base in the United States and recognized that a major factor in the success of this American venture was the need for effective communication and cooperation between the Dutch and American teams.

Budgeting for U.S. Salaries Matters

Understanding the salary landscape is vital to ensure you offer competitive compensation packages that attract and retain top talent. Keep in mind that it’s not just the salaries that may differ. Healthcare benefits in the U.S. can also come with significant costs. Let TABS guide you!

Beneficial Ownership Reporting

More and more publications and webinars are being advertised in connection with these reporting requirements that will soon take effect. Let TABS guide you!

Ready to Level Up Your U.S. Venture? It’s Time to Employ Locally!

Taking the step to employ locally is a crucial milestone on the path to success. However, before you dive into the hiring process, it’s essential to understand the financial aspects involved, especially when it comes to salaries and healthcare benefits in the U.S. compared to Europe.

‘Succes Starts With Pulling Out The Wallet’

BlueBiz KLM has interviewed TABS Inc. for an insightful article on doing business in the United States. Let TABS guide you!

Participate in TABS’ 2023 Survey!

Shape the future of U.S. expansion and receive the exclusive “The 2023 U.S. Expansion Report” by participating now!

Exciting News! Our New Office in Eindhoven, Netherlands

TABS is thrilled to announce the opening of our new branch in Eindhoven, the Netherlands, to better serve our valued customers!

TABS Talk – April 2023 (News for Your U.S. Venture)

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

TABS Continues to Grow and Enhance Customer Service

TABS is pleased to announce that our commitment to growth and exceptional customer service remains unwavering. To better serve our valued customers, we are excited to introduce Willem Wolfs as our new Business Relationship Manager.

Requirement to File Form 5471 with Corporate Income Tax

An unintended consequence of the Tax Cuts and Jobs Act passed during the Trump Presidency is that far more tax filers are now required to file Form 5471; this includes nearly all of TABS’s clients with overseas parents.

New York State to Require Electronic Workplace Posters

Acknowledging that more employees are working from home and away from their physical workplace, New York State now requires employers of all sizes to make mandatory workplace posters available to employees electronically, either on their website or by email, in addition to posting physical copies in the workplace.

Podcast Episode 5 – The U.S. Expansion Series

TABS spoke to Manny Schoenhuber, attorney at Jackson Walker LLP in Houston, Texas, to discuss liabilities in the US. Listen here!

Podcast Episode 4 – The U.S. Expansion Series

Frits Snel of Tony Chocolonely shares how they succeeded in the U.S. and talks about living in New York to oversee the U.S. market expansion.

TABS Talk – January 2023 (News for Your U.S. Venture)

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Consequence of Payrolling in the United States with a Foreign Entity

When a foreign entity wishes to enter the U.S. market, a major factor they may need to consider involves hiring U.S. employees. Here are some things to consider when reviewing whether to employ via a foreign entity and/or use a global PEO.

Podcast Episode 3 – The U.S. Expansion Series

For the third episode of the U.S. expansion series, we sat with attorney Daniel Glazer from Wilson Sonsini Goodrich & Rosati to discuss all the legal aspects of setting up and scaling your business in the U.S., from setting up a subsidiary to raising funds from U.S. investors.

TABS attended the Consumer Electronics Show (CES 2023) in Las Vegas

The Consumer Electronics Show (CES) is the most influential tech event in the world, the proving ground for breakthrough technologies and global innovators. CES 2023 showcased more than 3,200 exhibiting companies.

Podcast Episode 2 – The U.S. Expansion Series

The U.S. Expansion Series is a podcast on how to successfully expand your business to the U.S. market and provides companies with tools and guidance. The second episode concentrates on the top-performing marketplaces in the US and how an eCommerce business can maximize its revenue by integrating with these channels.

TABS Launches Podcast – The U.S. Expansion Series

The U.S. Expansion Series is a podcast on how to successfully expand your business to the U.S. market and provides companies with tools and guidance.

Impact of State Corporate Income Tax on Site Selection

Businesses may overvalue state CIT, and its pertinence to where the company should be established, but where a company is established does matter and can have lasting implications.

TABS Talk – November 2022

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

New Beneficial Ownership Reporting Requirements

The rule will require most corporations, limited liability companies, and other entities created in or registered to do business in the United States to report information about their beneficial owners—the persons who ultimately own or control the company, to FinCEN.

How the New Inflation Reduction Act Can Help Your Company

The new IRA creates specific changes to U.S. tax laws for European companies in the green energy and pharma sector.

10 Ways to Prevent Corporate Check Fraud

Check fraud is a massive issue in the United States for many incoming European businesses and can be a culture shock for many. TABS has come up with its top ten tips for avoiding check fraud.

Cost of Inflation: Minimum Wage Rises in Several States and Cities

The economic outlook for 2023 indicates that high inflation will persist into next year. This should also be taken into consideration while recruiting for open positions, current salary benchmarking tools may not be as up-to-date.

TABS Talk – September 2022

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Group Health Insurance and Premium Hikes for 2023

Many small group employers can expect to see double-digit percentage increases for premiums in 2023. Now may be the time to reevaluate your plan offerings.

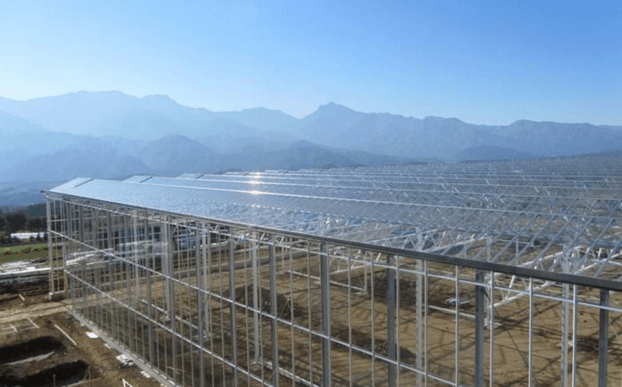

Client Interview: KUBO Full Service Grow Concepts

TABS spoke with KUBO’s Mario Verbraeken, Business Development & Sales Manager USA, about doing business in the United States.

Equity and Employees, How to Tackle this Complex Issue

Our business partner Wilson Sonsini Goodrich & Rosati are experts in making equity plans work for U.S. employees. They have written a very relevant article on everything you need to know.

What Makes a Dutch Venture in the US Successful? (podcast)

Our business partner Annette van der Feltz interviewed Floor Bergshoeff, Business Developer at TABS Inc., about what makes a Dutch venture in the US successful for the Dutch American Connection Podcast series.

TABS Talk – June 2022

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Client Interview: Channelengine

TABS spoke with Jordi Vermeer, VP of Revenue North America of ChannelEngine, about doing business in the U.S.

CalSavers: California’s Retirement Program Mandate

The state of California is requiring eligible employers to participate in a Retirement Savings Program called CalSavers, to ensure all California workers can plan for their future through automatic payroll contributions facilitated by their employer.

Retail Delivery Fee (RDF) – Colorado First to Charge (Online) Retailers for their Infrastructure

Do you sell taxable items that will be delivered by a motor vehicle to a location in Colorado (including deliveries made by a third party)? If the answer is yes, this impacts you!

TABS Talk – April 2022

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

ADA and PROP 65 Litigation Continues To Present Substantial Risk To Retailers

The U.S. is known as a litigious society in which a simple mistake can lead to multi-million-dollar claims. Fortunately, it is not as bad as often feared by foreign entrepreneurs

Cultural Aspects of Working as a European in the United States

Floor Bergshoeff, Business Developer at TABS was interviewed about “Cultural Aspects of Working as a European in the United States”.

TABS Talk – February 2022

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Prepare for the upcoming (2021) tax season

As your company prepares for the end of its tax year and begins to prepare for its reporting obligations in early 2022, don’t forget the following two important aspects in your preparations.

TABS Talk – November 2021

We have collected a number of interesting topics relevant for your U.S. venture. Let TABS guide you!

Internship & Traineeship Programs in the U.S.

Interested to learn more about internship and traineeship programs – but have no clue where to start? Are you and/or your company based in the US? Then Stage-Global is your answer!

1099 Tax Filing Deadline Approaching

This form is used to report business related payments made during the calendar year 2021. Let TABS guide you!

US-EU Agreement on Digital Service Tax

The Department of Treasury announced that the United States has reached an agreement regarding Digital Services Taxes (DSTs).

Auto-IRA’s

For those employers that do not currently have any type of retirement program in place, you may soon be required to set up an Auto-IRA. Let TABS guide you!

TABS Talk – September 2021

We have collected a number of interesting topics relevant for your U.S. subsidiary.

Get inspired: An interview with Thomas Vilmer, Vice President of TMC USA N.E.

TABS spoke with Thomas VILMER, Vice President of TMC USA North East in New York City, about doing business in the U.S.

How to Start a U.S. Business from Abroad

To start a business in the U.S. as a foreigner (from abroad) may look simply, however nothing is less true. Let TABS guide you!

U.S. Market Entry Grizzly New Marketing

TABS is proud to assist Grizzly New Marketing, specialist in search engine positioning, with their U.S. market entry. Grizzly offers a free website scan for the U.S. entity of TABS’ clients. Interested? Contact us.

Successful U.S. Market Entry Heliox

TABS congratulates its client Heliox with the opening of its North American headquarters in Atlanta (GA) early June. Despite the restrictions during the pandemic, Heliox managed to establish its new headquarters within two years after their U.S. market entry.

When Is The Right Time To Dive Into The Hot U.S. Economy?

When is it still OK to tip your toes in the water to assess the U.S. market, and when is the right time to ‘dive in’ and set up a U.S. subsidiary so you can maximize the benefits of the biggest global economy’s growth?

Affordable Health Insurance for Expats in the U.S.

TABS entered a unique collaboration to give access to affordable health insurance, offering our network many advantages if you join through TABS!

Top 5 Benefits of Outsourcing Back-Office Services for your U.S. Subsidiary

Outsourcing back-office tasks has long-been the solution to this headache for larger companies. TABS offers midsize to small companies to take advantage of the benefits of outsourcing as well.

Webinar Report: How To Successfully Negotiate in the U.S. Market

On April 21, 2021, TABS Inc. hosted a webinar on negotiating in the U.S. market. Read our report here.

About Registered Agents

Usually entities are not aware of which registered agent will be named or even that there are differences in the fees that registered agents may charge. If you are paying your registered agent directly and would like to change, contact us!

Webinar Report: The New Post-Covid Supply Chain Paradigm

On April 8, 2021, the EACCNY (European American Chamber of Commerce in New York) held a webinar on the challenges of Supply Chain Post-Covid. Read our report here.

FDA Extends Deadline to Obtain the DUNS as a Unique Identifier for Food Facility Registration through December 2022

The FDA extends the deadline to obtain the DUNS as a unique identifier (UFI) of registered food and beverage facilities (or that need to register) until December 2022.

TABS Animation

TABS is thrilled to share our new animation, which illustrates the support and services we offer to build your business in the U.S.

Pig & Hen Bracelets

Pig & Hen is a bold and adventurous brand producing handmade bracelets from Amsterdam for men capitalizing on a unique and authentic brand story. Many of their bracelets are purchased as a gift which inspired them to create a corporate gift program.

Interested? Click on the link below and receive a free sample!

Be Careful Submitting your W-8BEN

Be wary of these phishing emails that appear to be from the IRS. Never return any information, it’s identity theft.

Employee Retention Credit

The IRS urges employers to take advantage of the newly-extended employee retention credit, designed to make it easier for businesses that, despite challenges posed by COVID-19, choose to keep their employees on the payroll.

TABS Guides Pig & Hen to Efficiently Navigate U.S. Market

TABS facilitates Pig & Hen U.S. market entry.

Pig & Hen: “TABS is specialized in supporting Dutch companies who start and develop a U.S. business.”

Webinar Recording: Operating your U.S. Midwest Business in 2021

Last week’s webinar about efficiently operating your Benelux business in the U.S./Midwest was very successful. We thank everyone for the positive input and great reactions. Watch the recording here.

DEN Smart Home Named As CES 2021 Innovation Awards Honoree

TABS congratulates DEN Smart Home on being named a CES® 2021 Innovation Awards Honoree for DEN SmartStrike™ at the first-ever, all-digital CES 2021, the world’s most influential technology event, happening January 11-14, 2021.

Update Paycheck Protection Program

The Small Business Administration (SBA) published their guidelines for the Second Round of PPP loans (“PPP2”). With the new guidelines published it became clear that the SBA has also reopened their application for the first round of PPP loans and encourages eligible businesses that were not able to, or missed the deadline for the first PPP loan to apply now.

1099’s – Deadline January 31, 2021

The filing deadline approaches in January for forms 1099-MISC. This form is used to report business related payments made during the calendar year 2020. TABS is happy to review your records with you to assist with this process.

Webinar Report: Withum Analyzes the Since-Passed Stimulus Package

Paycheck Protection Plan Loan forgiveness and the new PPP Package (PPP2) were discussed on December 23th. The full report may be downloaded from TABS.

Join TABS in donating for ShelterShuit

Join us as people helping people, protecting the unsheltered and providing warmth and dignity. Donate today!

Dutch Ventures in the U.S. (DVITUS)

Get the latest insights from the 2020 ‘Dutch Ventures in the United States’ research project on how to successfully expand to and build your business in the U.S. market.

Sales Tax in the United States

Receive the memo TABS prepared to help try and explain the complicated system of sales & use taxes in the United States.

New IRS Limits for Health Saving Accounts (HSA’s) and Flexible Spending Accounts (FSA’s)

Important news for employers and employees from our HR Team.

Sheltersuit Is Keeping Homeless People Safe on the Streets by Turning Snowsuits into Sleeping Bags

TABS congratulates Bas Timmer of Sheltersuit who was named one of the Next Generation Leaders of 2020 by the influential American weekly Time magazine (circulation 5 million).

How the Trump Administration Has Impacted Dutch Company’s Presence in the U.S. Since 2017

While increased uncertainty and bureaucracy typically doesn’t help, Dutch companies in the U.S. seem to have benefited over the past few years from some of Trump’s policies and other market trends. After 4 years it is time to evaluate.

Joe Biden is the New President-Elect of the United States: How Might this Impact your Business in the United States?

We anticipate that a change of administration will not substantially impact the European companies. Read the complete article.

Daily Paper Debuts NYC Flagship Retailer Experience on the Lower East Side

TABS congratulates Daily Paper with their NYC debut, opening their flagship retailer experience on the Lower East Side.

FDA Registrations 2021-2022 are Open

Do you export goods to the U.S.? And, do you know if your product is FDA regulated?

Are you aware that FDA Food registrations for 2021-2022 must be filed by December 31st?

Webinar report: NAF-BIZ New York – Update U.S. travel restrictions for Dutch businesses – 29 July 2020

NAF-BIZ New York held an interesting webinar on travel restrictions for Dutch businesses on July 29, 2020. Jacob Willemsen of TABS was co-host on this webinar. Read the webinar report here.

How to do Business in the United States: Through the Eyes of a Life Sciences Executive

A blog from our partner AxelRx, specialists in supporting Life Sciences ventures with all necessary services to set up, accelerate or do business overseas. With AxelaRx being part of the TABS network, TABS is able to offer its Life Sciences clients a reliable business partner in the United States.

Dutch Ventures in the Unites States – research project (DVITUS)

With this research project we are aiming to help Dutch companies that have entered the U.S. market, get a better understanding of the market and the pitfalls they could encounter. Register to take part in the 2020 research project or read the 2014 report.

TABS and AxelaRx Partnership

TABS Inc. is thrilled to announce the new partnership with AxelaRx Biosciences. Together we are passionate about transforming challenges of European Life Sciences and Health companies into successes in the United States.

An article on American culture

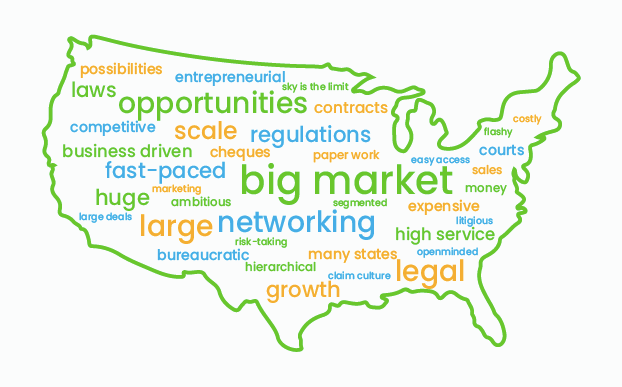

Congratulations, your European product is a success in several EU countries. You are ready to make the leap across the Atlantic Ocean and conquer the US market with your amazing product and corresponding impressive statistics. America… the land of opportunity! The sky is the limit!

E visa issuance fees

Recently the US State Department increased visa reciprocity fees and adjusted validity periods for several countries in Europe including Belgium, France, Spain, Norway, Austria, Italy and the Netherlands. This is in response to President Trump’s Executive Order 13780, which requested that the U.S. Department of State undertake a worldwide review of reciprocity arrangements and to update any discrepancies.

Tax reforms 2020

In December of 2017 the Tax Cuts and Jobs Act (TCJA) ushered in some significant tax changes for businesses. One of the key benefits of the TCJA for businesses was a lower tax rate for C-corporations that became effective in the 2018 tax year. The graduated “C-corporation” tax rates were reduced from a range of 15% – 35% to a flat 21%. Keep in mind that this is only applicable in connection with federal corporate income taxes; State corporate tax rates may still apply depending upon the state.

A quarter more companies export to the US

In 2018, 8.9 thousand Dutch companies exported goods to the United States, more than a quarter more than in 2015. This increase is stronger than that of the total number of exporting companies, which was 10 percent larger than three years earlier. This is evident from new figures from Statistics Netherlands (CBS), published in the […]

Why Texas? The Movie

Most companies that want to do business in the United States think about the West coast and the East Coast. They don’t think about Texas at first. As the 10th economy of the world, the Lone Star State has so much to offer. Texas ranks at the top of nearly every “best states to do business list”, […]

2019 End of year TAX preparations

As the deadlines to file 2018 taxes on extension approach (15 September for partnerships and disregarded corporations and 15 October for other corporations), it’s not too early to begin preparing for next year’s tax season. Below is a list of important tax deadlines for businesses in 2020. You should note that the first deadline is January […]

Rabobank – Mechanics Bank merger

The strategic merger of Rabobank, N.A. (Rabobank’s retail bank in California) and Mechanics Bank was completed in 2019. In line with Rabobank’s ‘Banking for Food’ strategy, Rabobank N.A. was sold to Mechanics Bank, while its food and agri activities were retained by Rabobank Group. This merger brought together two community-oriented, well-capitalized banks with common values […]

What’s in a name? An article by Annette van der Feltz- Expatriate Assistance

What’s in a name? If you are moving to the US on a work visa – the answer to this question could be: a lot! When moving to the US, getting your name registered correctly, and understanding how the various government agencies determine your first, middle, maiden and last name, is crucial to a smooth […]

Get inspired: An interview with Dennis Tan, CEO and Co-Founder of Dashmote

Dashmote is all about helping people to get the most out of their data. For example business professionals, working in sales/marketing, who want to work with data but don’t have all necessary resources to do so. Dashmote created a platform that gives the end users more control over their data. Read all about it in our inspiring […]

Individual coverage health reimbursement arrangements for health plan coverage.

With the Healthcare Open Enrollment season approaching for most employers, coming in 2020 there is a new option (especially for small employers) that many are calling “a game changer for health insurance coverage”. To help TABS clients understand and navigate the constantly changing world of health care insurance plan options TABS is here to help guide […]

2019 Tax Filings

As the end of the calendar year draws near, which for most of our clients is also the end of their fiscal year, it is time to consider tax planning moves to minimize your tax burden and prepare for the upcoming tax filing season. The Tax Cut and Jobs Act of 2017 created certain […]

Podcast De Oversteek: creditcards en cheques; zo doe je zaken in de VS

Hoe zorg je ervoor dat je in de VS je product aan de man brengt, dat klanten geld overmaken en dat je een lening krijgt? Oftewel, hoe doe je er zaken? Dat hoor je in de vierde aflevering van De Oversteek. Terwijl president Trump er niet aan twijfelt dat de economie van de VS winning is, zijn […]