Requirement to File Form 5471 with Corporate Income Tax

An unintended consequence of the Tax Cuts and Jobs Act passed during the Trump Presidency is that far more tax filers are now required to file Form 5471; this includes nearly all of TABS’s clients with overseas parents.

The Internal Revenue Code previously only required a U.S. taxpayer who owned a certain portion of a controlled foreign corporation (“CFC”) to file Form 5471 – the form’s title is Information Return of U.S. Person with Respect to Certain Foreign Corporations.

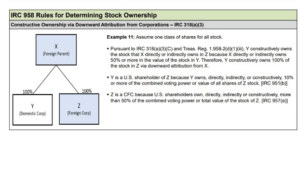

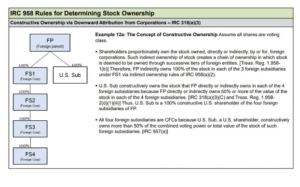

This was due in large part because the constructive ownership rules of Section 318 were ‘mitigated’ by Section 958(b)(4), which the Tax Cuts and Jobs Act repealed. As a result of the repeal of Section 958(b)(4), upward and downward attribution rules under the Act have created ‘constructive ownership’ scenarios that now require U.S. corporations with a foreign parent to file Form 5471 for the parent company and any subsidiary of that parent wherein the parent has a fifty percent or more ownership interest. Though likely unintended, the repeal created a situation whereby the wholly-owned U.S. subsidiary is at the same time considered the constructive owner of the foreign parent. Until this issue is corrected, your company is likely required to file at least one Form 5471 as a category 5c filer with your 2022 Corporate Income Tax.

In an effort to provide explanations and examples, The Internal Revenue Service Large Business & International Concept Unit published IRC 958 Rules for Determining Stock Ownership – Ownership Attribution Issue (latest version 8 August 2022), showing how upward and downward attributions create constructive ownership requiring the filing of Form 5471 – even for wholly owned subsidiaries of a foreign parent.

Reproduced below are two slides that are relevant to most of our clients from that publication showing that a 5471 is now required. Following those two slides is additional information regarding Form 5471 and its filing.

Failure to file

Importantly, failure to file a Form 5471 may result in penalties equal to $10,000 for each foreign corporation which could become quite costly.

What are you required to file

A category 5c Filer is required to provide responses to the following with regard to Form 5471:

- Identifying information on page 1 of Form 5471 above Schedule A for each controlled foreign corporation which includes:

- Schedule B, Part II

- Separate Schedule E (not Schedule E-1)

- Schedule G

- Separate Schedule G-1

- Schedule I-1

To prepare returns with the properly prepared Form 5471, you will need the following information contained in the attached Sheet.

IMPORTANT: IF YOU USE THIS TEMPLATE, PLEASE DOWNLOAD IT FIRST TO PREVENT YOUR CONTENT FROM BEING SAVED IN THE ORIGINAL DOCUMENT.