How to Start a U.S. Business from Abroad

Starting a U.S. business is the key to success for many businesses around the world. The best way to take advantage of the world’s largest, best integrated national market, is a U.S. market entry. To start a business in the U.S. as a foreigner (from abroad) may look simple, however, nothing is less true. With the help of an experienced team who understands the laws and requirements of doing business in all 50 U.S. states, such as TABS, you’re much more likely to be successful in the U.S.

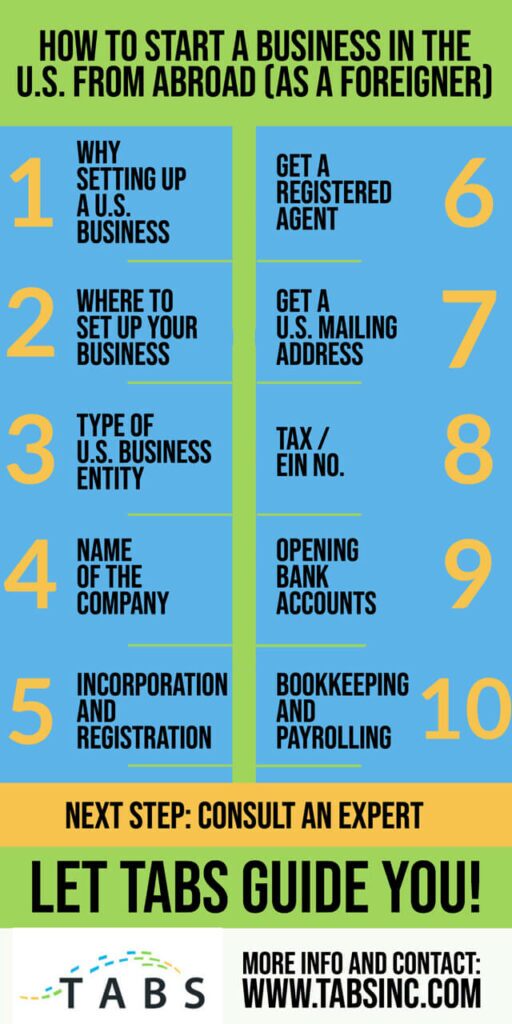

Checklist to Start a U.S. Business from abroad as a Foreigner / Non-Resident

Steps you need to take to start your U.S. business

1. Why set up a business in the U.S. as a foreigner

It’s important to determine in advance why you want to set up a U.S. entity and what you want to do with it because that partly determines where and how you can do that best. An important reason for this is to protect the European entity from unnecessary legal and tax exposure. Also, companies that enter the U.S. market with a local entity have demonstrated above-average growth.

2. Where to set up your business in the U.S.

In the U.S., the state of incorporation of the company may be different from the state where the company locates its operations. Incorporation and registration are two independent actions. The company must be registered with the states in which it establishes its operations and must pay income taxes in the state or states where revenue is generated, regardless of the state in which it was incorporated.

3. Type of U.S. business entities

By far the most common options available to fully owned subsidiaries of foreign companies are Limited Liability Corporation (LLC) and C-Corporation (C-Corp). The choice of the type of company must be made with the necessary legal and tax support to fully understand all the consequences and ensure that it is the most appropriate for its objectives.

4. Name of the company

The legal name of the company may have to vary slightly depending on the state and the type of company. Not only in the selected state for incorporation, but also in states where you anticipate doing business in the future. It is important to verify the absence of conflicts with registered trademarks and the availability of required domains on the Internet. It is also advisable to explore the possibility of registering trademarks and patents to protect the intellectual property of the company.

5. Incorporation & Registration for foreign authority

When the previous decisions have been made, the company can be incorporated in the selected state (home state) and must then be registered for foreign authority in states where it creates a nexus (economic ties with that state). Almost all states require that a “foreign” or “foreign entity” company (that is, one that was incorporated in another state) must register as required by state law before it begins operating in that state. What state law defines as “doing business” in that state will determine if registration is necessary. In general, if the company has an office, a store, a warehouse, or employees in a state other than the one selected for its incorporation, it must be registered as a foreign company in that state.

6. Get a Registered Agent

All companies must designate a Registered Agent in the state selected for their incorporation as well as the states in which they register for authority. Since the administrators and partners may be non-resident foreign citizens, the agent ensures the reception of all official documents related to the business. Typically a registered agent is not your standard mail address. By choosing your registered agent, consider whether they allow for other mail to be received at that address. Beware, it is a non-transparent market with a lot of rate fluctuations. The added value of a registered agent differs per agent.

7. Get a U.S. Mailing Address

Many U.S. authorities and private parties will require a mailing address or residential address (e.g. for opening a bank account). When choosing your mailing address make sure that you have constant access as many authorities still have official communication per physical mail only.

8. Tax / EIN

All companies must be registered with the Internal Revenue Service (IRS) and need to obtain an ‘Employer Identification Number’ (a.k.a. EIN or Tax Identification Number), which is required to identify the company, open, and operate bank accounts, and file the corresponding tax returns. The process must be carried out by a representative with a valid SSN (Social Security Number) or another natural person with a taxpayer identification number (e.g., ITIN). It is also necessary to indicate a company address for notification purposes, which can be the final address or a temporary address.

After obtaining the EIN, the company must choose the classification of the business for tax purposes. Once created, the company must also be registered with the tax authorities of the states in which it carries out business activities.

9. Bank Accounts

The following conditions must be met by the company before opening its initial bank accounts, providing to the bank the corresponding documents:

- Registration & company formation documents (Certificate of Incorporation, Bylaws, Board Resolutions).

- EIN, official communication from IRS assigning tax id to the company.

- Proof of address for the company as well as authorized signers.

- Organization chart including an overview of ultimate beneficial owners of the entity.

10. Bookkeeping & Payrolling

It is necessary to ensure that the company keeps detailed records of its transactions to ensure compliance. Especially in financial administration and payroll, there are subtle changes between Europe and the U.S. These activities, which can be outsourced to service companies at an early stage, should be undertaken by people with the necessary qualifications and experience with intercompany loan agreements, transfer pricing, and special reporting requirements for foreign-owned subsidiaries.

Next step: Let TABS guide you!

To start a business in the U.S. as a foreigner from abroad is complicated and challenging. Doing everything correctly can save you thousands of dollars in taxes, administration costs, and wasted time. Legal, accounting, and tax issues are very important and should always be checked with experts who have the required licenses. Consulting an expert is a valuable investment if you’re serious about starting your business.

TABS helps European companies with their U.S. Market Entry

Contact us!

TABS facilitates European-based companies to successfully enter the U.S. market. Schedule a free consultation call here.