Group Health Insurance and Premium Hikes for 2023

Many small group employers can expect to see double-digit percentage increases for premiums in 2023. According to this article, the average price increase is at 10%, with some insurers requesting increases up to 20%.

Though TABS’ HR team has already seen several notices from insurance carriers requesting premium rate changes upwards of 19% in New York, it ultimately depends on the State’s Department of Financial Services to approve these requests, also further explained in this article for New York-based employers*.

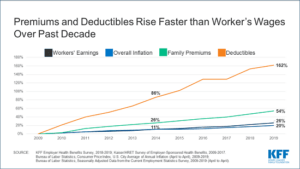

According to this article, Connecticut employers may see even higher premium increases. Ultimately, premium increases depend on several factors, including industry performance, group performance and usage, as well as market performance. These factors may also differ by state. On the other hand, an increasing number of employees see the importance of getting affordable insurance benefits offered by their employers, as inflation continues to affect their budget. Below graph from KKF shows how fast insurance costs increase compared to employees’ wages over time.

Now may be the time to reevaluate your plan offerings. TABS’ HR Team is happy to assist you with any questions or reviews of your benefits. Together with our partner brokers, we can find the best solution for your group of employees. Whether it be a change of plans offered, a switch of insurance carriers, a PEO, or a switch to an Individual Healthcare Arrangement, we are here to assist you further. Contact us!

*It is important to note that these percentages do not reflect the rate increase your company may see upon renewal. As mentioned, premium increases are based on several factors.